Along with the economic impact of intangibles and the fact that many companies now finance growth from the income statement instead of the balance sheet. Buffett espoused using book value to value Berkshire for years before the company’s nature changed and how he believed Berkshire would continue to grow. Berkshire continues to buy back shares above book value but below intrinsic value. It helps illustrate how book value represents a snapshot in time, not allowing for future growth or profitability. Book value per share is a reflection of a company’s total tangible assets minus its total liabilities. Lastly, observing changes in a company’s book value per share over time can indicate a company’s health or management effectiveness.

Increase Assets and Reduce Liabilities

Next, let’s look at another financial institution that you may not have heard much about, although it is one of the country’s largest insurance banks. Value investors have traditionally embraced book value per share as a method of valuing different investments. In conclusion, book value per share can hold meaningful implications for a company’s commitment to CSR and sustainability.

Informing Fair Price in M&A Deals

Conversely, when the market value per share is significantly higher than the book value per share, the company may be seen as overvalued, suggesting that its stock might be trading at a premium. To use the formula, first find the total book value and the number of outstanding shares. If a company has a book value per share that’s higher than its market value per share, it’s an undervalued stock. Undervalued stock that is trading well below its book value can be an attractive option for some investors. Sandra Habiger is a Chartered Professional Accountant with a Bachelor’s Degree in Business Administration from the University of Washington.

How Book Value per Share Differs from Market Value per Share

You can use the book value per share formula to help calculate the book value per share of the company. For example, let’s say that ABC Corporation has total equity of $1,000,000 and 1,000,000 shares outstanding. This means that each share of stock would be worth $1 if the company got liquidated.

- Price to book is a favorite of value investors as it gives a good indication of the relation of the company’s book value to its price.

- It’s a measure of what shareholders would theoretically get if they sold all of the assets of the company and paid off all of its liabilities.

- If a company’s share price falls below its BVPS, a corporate raider could make a risk-free profit by buying the company and liquidating it.

- Book Value Per Share also theoretically reflects what shareholders would receive in a company liquidation after all its assets were sold and all of its liabilities paid.

- If XYZ can generate higher profits and use those profits to buy assets or reduce liabilities, the firm’s common equity increases.

It depends on a number of factors, such as the company’s financial statements, competitive landscape, and management team. Even if a company has a high book value per share, there’s no guarantee that it will be a successful investment. This is why it’s so important to do a lot of research before making any investment decisions.

Book Value Per Common Share (BVPS): Definition and Calculation

Price-to-book (P/B) ratio as a valuation multiple is useful when comparing similar companies within the same industry that follow a uniform accounting method for asset valuation. It can offer a view of how the market values a particular company’s stock bookkeeping to run your business and whether that value is comparable to the BVPS. It approximates the total value shareholders would receive if the company were liquidated. For instance, consider a company’s brand value, which is built through a series of marketing campaigns.

Therefore, the BVPS for Google will likely undervalue the company if it does not account for these assets. In the process of M&A, it’s crucial to establish a fair price for the company that is being acquired. The book value per share can assist here by suggesting a baseline for negotiation. If a company’s market value is significantly higher than its book value, it may indicate that the market has high expectations for the firm’s future earnings. Conversely, if the market value is lower, it may be a signal the company is undervalued, or the market anticipates future problems.

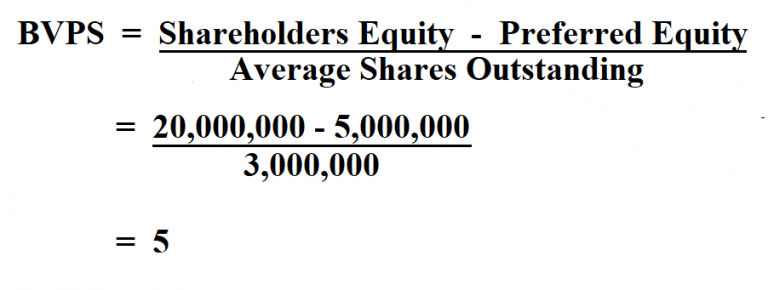

To put it simply, this calculates a company’s per-share total assets less total liabilities. To get BVPS, you divide the figure for total common shareholders’ equity by the total number of outstanding common shares. To obtain the figure for total common shareholders’ equity, take the figure for total shareholders’ equity and subtract any preferred stock value. If there is no preferred stock, then simply use the figure for total shareholder equity.

The market value per share is a company’s current stock price, and it reflects a value that market participants are willing to pay for its common share. The book value per share is calculated using historical costs, but the market value per share is a forward-looking metric that takes into account a company’s earning power in the future. With increases in a company’s estimated profitability, expected growth, and safety of its business, the market value per share grows higher. Significant differences between the book value per share and the market value per share arise due to the ways in which accounting principles classify certain transactions.

We’ll assume the trading price in Year 0 was $20.00, and in Year 2, the market share price increases to $26.00, which is a 30.0% year-over-year increase. The formula for BVPS involves taking the book value of equity and dividing that figure by the weighted average of shares outstanding. The book value of equity (BVE) is the value of a company’s assets, as if all its assets were hypothetically liquidated to pay off its liabilities. A company’s balance sheet may not accurately represent what would happen if it sold all of its assets, which should be taken into account.

Join the conversation