This account is used to record the income earned from the sale of goods or services. These accounts are used to record the cost of acquisition and depreciation of these assets. The balance of these accounts decreases over time due to depreciation.

What is a Temporary Account?

The balance in a permanent account is carried forward to the subsequent year, where it becomes the beginning balance for the new year. Again, real accounts are permanent and stay open from period to period, including at year-end. Allow us to give you the scoop with an overview, examples, and more. The three main types of accounts in business are assets, liabilities, and equity.

Traditional Approach to Accounting

This account is used to track the amount of money that the company owes to its suppliers and to ensure that the company is paying its bills on time. Asset accounts are a type of account that records the assets of a business. These accounts are used to track the value of assets owned by the business, such as cash, inventory, equipment, and property.

How Can Automation Enhance the Management of Temporary and Permanent Accounts?

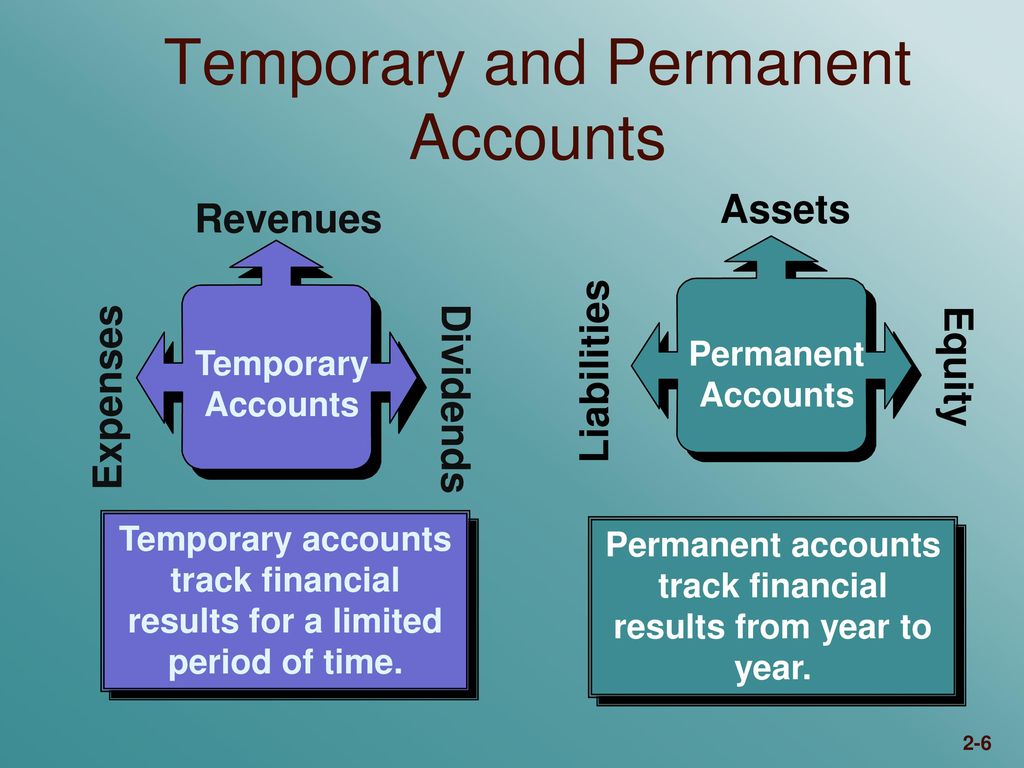

Permanent accounts, also known as real accounts, are balance sheet accounts that track the ongoing financial health of a business. These accounts don’t close at the end of an accounting period, as opposed to temporary accounts which are cleared at the end of each period. Permanent accounts are those accounts that continue to maintain ongoing balances over time. All accounts that are aggregated into the balance sheet are considered permanent accounts; these are the asset accounts, liability accounts, and equity accounts. In a nonprofit entity, the permanent accounts are the asset, liability, and net asset accounts. Permanent accounts are the exact opposite of temporary accounts which are closed at a period-end.

- Examples include rent expense, which records costs related to office or retail space, and salary expense, which captures employee wages.

- The balances in these accounts should increase over the course of a fiscal year; they rarely decrease.

- Permanent accounts are accounts that are not closed at the end of the accounting period, hence are measured cumulatively.

- The balance of these accounts decreases over time due to amortization.

- The balance sheet is useful for investors and creditors to assess a company’s liquidity, solvency, and financial stability.

- All accounts that are aggregated into the income statement are considered temporary accounts; these are the revenue, expense, gain, and loss accounts.

Again, real accounts can be broken down into asset, liability, and equity accounts on the balance sheet. For example, the cash account is a type of asset account, accounts payable is a liability account, and retained earnings is an equity account. Temporary accounts are not carried onto the next accounting period.

Your permanent accounts become your beginning balances at the beginning of the new period. And, your beginning balance consists of the amounts in your cash, fixed assets, and inventory accounts. The balances in these accounts carry over from one period to the next, which allows the business to keep track of its financial health over the long term. For instance, the Cash account isn’t cleared at the end of each accounting period. Instead, the balance at the end of one period becomes the beginning balance for the next period.

Insufficient documentation is another challenge businesses face when managing temporary and permanent accounts. Without proper documentation, it can be challenging to track financial transactions accurately. Adequate documentation is necessary to ensure accurate financial reporting and ensure compliance with regulatory requirements. When you close a temporary which of the following accounts are permanent account at the end of a period, you start with a zero balance in the next period. Permanent accounts (also called real accounts) are those ledger accounts whose closing balance in one period becomes their opening balance in the next period. These accounts record what the business owes to others, representing obligations to be settled in the future.

A chart of accounts is a list of all the accounts used by a company to record its financial transactions. It is usually organized in a hierarchical structure that groups similar accounts together. There are many different types of expenses that a business may incur, including insurance, payroll, and other expenses related to running the business.

Join the conversation