The FIFO method is equally important in the manufacturing industry, where raw materials and components are crucial for production. Manufacturing businesses often receive materials in batches, and the FIFO principle ensures that the oldest batch is consumed first. By using older inventory first, manufacturers can prevent material waste, reduce inventory holding costs, and maintain quality within their production processes. For instance, a manufacturing company can use the FIFO method to determine the cost of raw materials used in production.

What is FIFO inventory management?

Jami has collaborated with clients large and small in the technology, financial, and post-secondary fields. Learn more about what types of businesses use FIFO, real-life examples of FIFO, and the relevance of FIFO with frequently asked questions about the FIFO method. Going by the FIFO method, Sal needs to go by the older costs (of acquiring his inventory) first. Statements are more transparent and it’s more difficult to manipulate FIFO-based accounts to embellish the company’s financials.

- This method is vital for ensuring efficient inventory management, maintaining accurate financial records, and adhering to accounting standards.

- When sales are recorded using the LIFO method, the most recent items of inventory are used to value COGS and are sold first.

- This is especially important when inflation is increasing because the most recent inventory would likely cost more than the older inventory.

- However, it is important to note that the LIFO method can result in the opposite effect, with a lower valuation of inventory and a higher cost of goods sold.

Do You Report Inventory at Cost or Retail?

It can save you both time and money by calculating the exact cost of the inventory you’ve sold since your costs are reliant on the cash flows of your previous purchases. Companies with perishable goods or items heavily subject to obsolescence are more likely to use LIFO. Logistically, that grocery store is more likely to try to sell slightly older bananas as opposed to the most recently delivered. Should the company sell the most recent perishable good it receives, the oldest inventory items will likely go bad.

Examples of Calculating Inventory Using FIFO

It plays a crucial role in various industries, from retail to manufacturing, and helps businesses accurately track their stock movement and financial performance. Due to the consistent increase in vehicle costs the LIFO method can provide you with significant income tax benefits and deferment. LIFO also minimises write-downs of vehicles to fair market value minimum level of stock explanation formula example or the price a vehicle would sell for in an open market, because of a decline in inventory costs. Choosing the wrong inventory valuation method can impact your tax obligations and the efficiency with which you run the business. The main disadvantage of using the FIFO valuation method is that it will result in higher profits during times of inflation.

Advantages of LIFO

By following the steps outlined above, warehouse owners and operators can successfully implement a FIFO system to ensure that products are managed effectively and efficiently. As mentioned earlier, the FIFO method can result in a higher valuation of inventory and a lower cost of goods sold, which can have a positive impact on the company’s financial documents. However, it is important to note that the LIFO method can result in the opposite effect, with a lower valuation of inventory and a higher cost of goods sold. This can be beneficial for businesses in certain circumstances, such as when prices are rising and the LIFO method results in a lower taxable income. FIFO impacts financial statements by typically reporting higher profits during inflation. It results in lower cost of goods sold and higher ending inventory values on the balance sheet.

Enhancing investor and lender perceptions by reflecting current market prices in inventory valuation may be most desirable in industries where asset valuation impacts financial health. While FIFO may lead to higher taxable income due to lower COGS in times of rising prices, in jurisdictions where tax implications are favorable, this can be a strategic advantage. In particular, a more conservative approach to inventory valuation more closely aligns with standard accounting practices. Since FIFO aligns inventory operations with financial reporting, inventory valuation transparency increases.

By prioritizing the consumption or sale of older items, businesses can minimize product obsolescence, accurately calculate costs, and enhance inventory valuation. Utilizing the FIFO method also helps businesses to accurately calculate their COGS and inventory valuation. This is because the oldest items are being used to fulfill customer orders, meaning that their costs are reflected in COGS instead of more expensive new items.

I tell you that FIFO is so much better than LIFO, and yet this graph seems to indicate that LIFO is actually faster. Inventory is generally understated on your balance sheet when using the LIFO method because its valuation is based on the oldest costs. This means that your working capital position may appear worse than it is. It provides a better measurement of your business’s current earnings, reducing inventory profits by matching your most recent costs against your current revenues. The FIFO pricing method of valuation is simple to understand but may get difficult to use when you’re attempting to extract your costs of goods. This is because a significant amount of data is required for this method which can result in accounting errors.

To calculate COGS (Cost of Goods Sold) using the FIFO method, determine the cost of your oldest inventory. But FIFO has to do with how the cost of that merchandise is calculated, with the older costs being applied before the newer. This is often different due to inflation, which causes more recent inventory typically to cost more than older inventory. While FIFO is a popular and effective method for the management and valuation of inventory, it is not the only option available. Let’s discuss some of the other methods for valuing inventory and how they compare to FIFO.

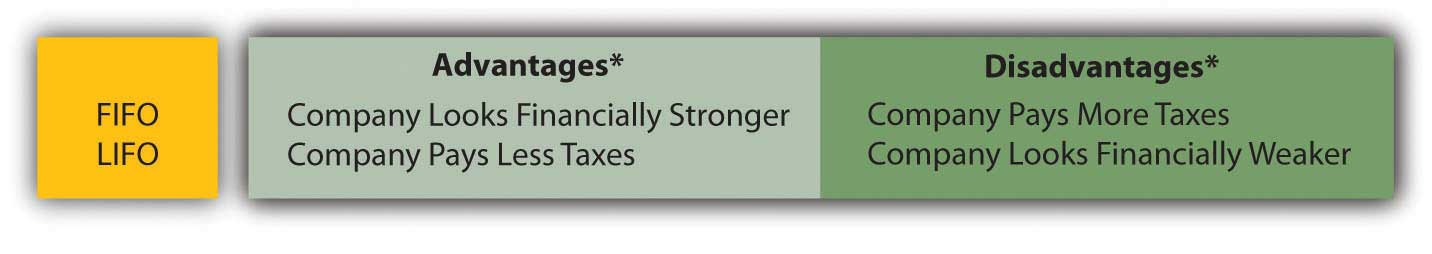

While FIFO is generally straightforward, it can be more complex to implement than LIFO (Last-In, First-Out) in certain situations. FIFO requires detailed record-keeping of purchase dates and costs for each inventory batch. When a company selects its inventory method, there are downstream repercussions that impact its net income, balance sheet, and ways it needs to track inventory. Here is a high-level summary of the pros and cons of each inventory method.

Utilizing FIFO ensures that earlier stock is dispatched first, reducing the likelihood of selling outdated models or designs. FIFO’s widespread acceptance and straightforward logic mean it is supported by the majority of accounting and inventory management software. Mobile inventory management solutions like RFgen can automatically enforce FIFO rules in the warehouse. FIFO encourages the rotation of stock, which can lead to better inventory quality overall.

Join the conversation